Having a sound estate plan is not something reserved for only the “ultra-wealthy.” While it’s true the 2025 estate tax exemption is nearly $14 million per person, the exemption amount is subject to change at any time, and there are many other considerations when designing an estate plan suitable to meet your legacy goals and provide peace of mind to you and your family. Here is a simple estate planning checklist to make the process of creating an estate plan easier:

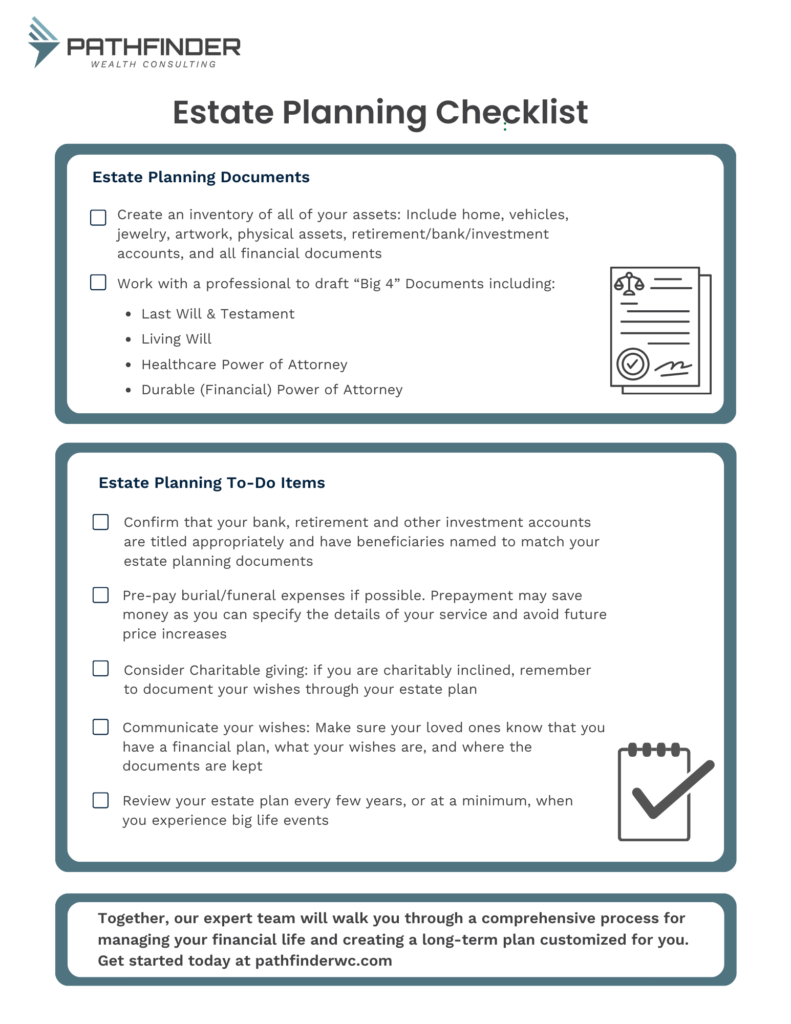

Estate Planning Checklist Documents:

- Create an Inventory all of your assets: including your home, vehicles, jewelry, artwork, other physical assets, investment/bank/retirement accounts, contents of a safe deposit box, insurance policies, etc. Having a comprehensive list of these items can go a long way in aiding with the administration of your estate, so that your executor has a guide to reference when distributing your assets to your heirs.

- Draft the “big 4” documents: As financial planners, when we reference an “estate plan,” we include all the basic documents. These documents include:

- A Last Will & Testament

- A Living Will

- A Healthcare Power of Attorney (POA)

- A Durable (financial) POA. These additional documents can be as important as, if not more so than, a Last Will, as they provide instructions for your wishes while you are still living but incapacitated. This should be a top priority if you are married or have children/other dependents as these documents will name an individual(s) to act on your behalf if you are incapacitated and will also name legal guardians for children. If you are incapacitated or pass away, these documents can provide a blueprint for loved ones during an already stressful time and reduces the burden of decision-making for them.

To Do Items for Your Estate Planning Checklist

- Confirm that your bank, retirement, and other investment accounts are titled appropriately and have beneficiaries named to match your estate planning documents: At Pathfinder Wealth Consulting, as part of our financial planning process we verify all existing account beneficiary designations, and we perform a beneficiary audit on all of our clients’ accounts each year to ensure any changes are accounted for. *It is important to note that some states require a spouse to sign a waiver if they are not named as the sole primary beneficiary on retirement accounts, so you’ll want to confirm if this is true in the state where you live.

- Pre-pay burial/funeral expenses: If you know your preferred method of burial, you can make your intentions known ahead of time and can actually pay the costs now. This is not the most glamorous or exciting investment, but this pre-planning could go a long way in helping your family members who will be grieving and may have a hard time dealing with other decisions that need to be made. Pre-payment may also save money, as you can specify the details of your service and avoid future price increases.

- Consider charitable giving: If you are charitably inclined, there are many ways to gift assets to qualified charitable organizations during your lifetime, and through your estate. Along with accomplishing philanthropic goals, many of these methods avoid taxation, meaning a larger portion of the assets goes directly to the intended recipient(s) instead of being lost to taxes.

Additional Considerations for Your Estate Planning Checklist

- Communicate your wishes: Planning is great, but it may be rendered ineffective if those you have named in your documents aren’t aware of the plan or don’t know where to locate your written documents. One way to accomplish this is through family meetings with those we are closest to who may ultimately be the ones that carry out final wishes. The holidays may be a great time to do this, since they are sometimes the only time the whole family gathers together. If you aren’t sure how to start the estate planning conversation with loved ones, we are able to offer some talking points to help.

- Review your entire estate plan every few years: Or, at a minimum when you experience big life events such as moving to a new state, birth or death of beneficiaries, marriage, or divorce. As part of our ongoing comprehensive financial planning process, we review clients’ current estate planning documents.

If you would like a downloadable PDF version of the estate planning checklist, you can download it here!

If you aren’t sure where to begin with creating an estate plan or financial plan that meets your current and future goals, or if you need a second opinion to determine if your current estate planning checklist is appropriate, please reach out to us. At Pathfinder Wealth Consulting, our comprehensive financial planning process includes helping you better understand your estate planning needs, making recommendations for which essential documents you need, and helping you make necessary updates to your estate plan as you journey through life.

If you are thinking about your legacy, or if you will be a part of the estate administration for a parent/family member, visit our Life Transitions page, or contact us for more information. We are here to guide you forward.

Pathfinder Wealth Consulting does not provide legal or tax advice. You should consult a legal or tax professional regarding your individual situation. Advisory services offered through Commonwealth Financial Network®, a Registered Investment Advisor.